- Published on

A Business Moat - What it is & How to Find Them

- Authors

- Name

- Jeremy Persing

What is a moat?

If you've ever heard talks from Warren Buffett or read books on investing, you've probably come across the term moat. It can be kind of confusing if you've never heard it before, because a moat is something around a castle has nothing to do with a business, but it is just an expression to signify the reason a business does better than its competitors. As an investor, it is your job to figure out what a company's moat is, how sustainable it is, and how easy it is to replicate, Let's get into some examples of moats and lay out some tips on what to look for.

Examples

A few examples of moats include

- Google and their search engine.

- NVidia and their GPUs. They make the best GPU on the market.

- Microsoft and all of their services. Microsoft is one of the most fascinating businesses, because somehow they are an oligopoly/duopoly in 5 different sub-sectors of tech (and I could very well be missing some). These include

- Operating Systems (Windows)

- Gaming (Xbox, not to mention their game studios)

- Cloud Computing (Azure)

- Code Storage / Git Repositories (GitHub)

- Office Tools (Microsoft Office)

- Costco and their sweet deals.

- Amazon

- Prime

- The ability to undercut just about anyone until they either use Amazon to sell their product or go bankrupt.

- AWS

- Prime video

How to Identify a Moat

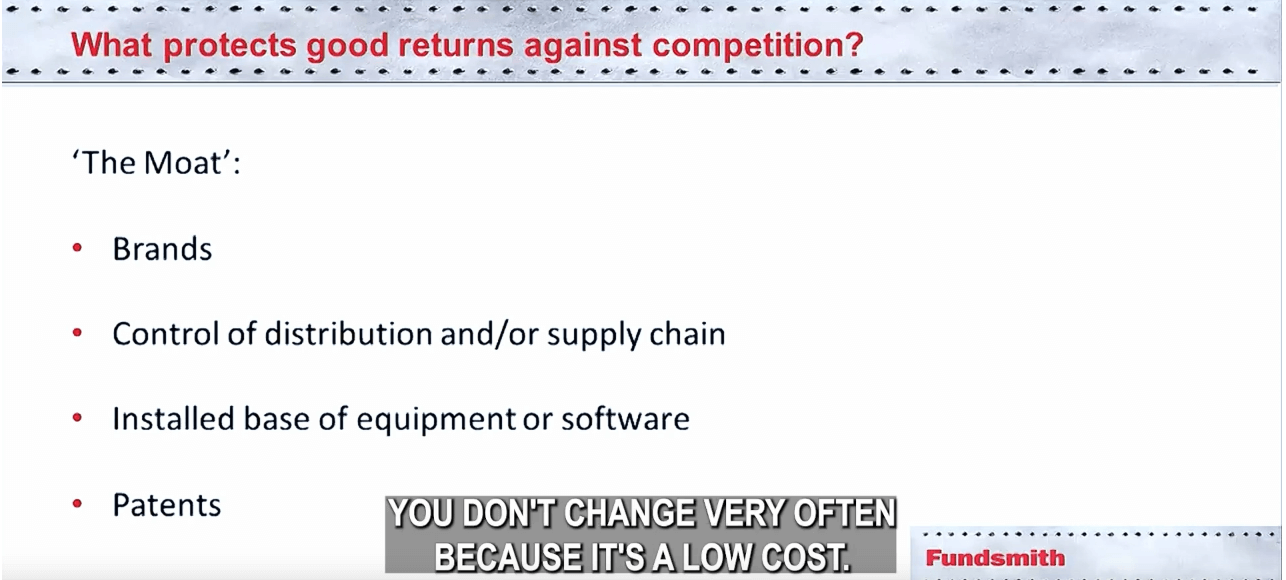

Above is an image from Terry Smith that details some of the things that can contribute to a moat. Generally speaking, the brand is the easiest to identify. One thing that I look for when it comes to brand is that there is typically an emotional connection to the brand, or status connected to the brand. Companies that come to mind for status side of the equation are Supreme, Louis Vuitton, Apple, and Ferrari. For the emotional side of the equation, some brands are Coke, Pepsi, In-n-Out Burger, Chik-fil-a, Whataburger, NVidia, AMD (NVidia vs AMD), Microsoft, and Apple (Mac vs PC). If you get a bad feeling about the brand when you think of it, and the company produces consumer goods, then it's probably a sign that you don't want to own that business.

To expand upon the control of distribution or supply chain, look into a company's existing relationships with customers and how easy it would be for someone else to develop the same relationship with those same customers. As we have seen, a company like Netflix will have a much harder time keeping its existing customers when a similar service comes out.

On the installed equipment or software piece, we can look to something like Microsoft Office, or Bloomberg Terminal. These products have up front costs associated with learning them and becoming competent with them. Once users have devoted time towards becoming proficient with them, there is little reason to switch to another service, especially when productivity gains are minimal and savings are minimal.

On this same piece, Smith invests in elevators and escalators companies because once these things are installed, they must be serviced until they are removed, and the companies that created and installed the products are also the ones that service them.

Patents are probably the least reliable, because they have a definitive time span on them.

Some things that I think Smith left out of his slide, but follow in his own investing, are if the company makes an addictive product or the government tries to limit, or outlaw, the number of businesses that can operate in an industry. Companies like Coke, Philip Morris, Meta, and Google (YouTube) fit this addictive criteria. And a company like Philip Morris fits the latter criteria.

Questions you Should be able to Answer

- What do they offer that nobody else does? (Quality of products, cost of products, etc)

- Is this sustainable?

- Who are their competitors?

- Can you easily replicate their business?

- Are there network effects with this & critical mass that’s needed for the business?

- Are they reliant on a few customers?

- What is their unfair advantage? (They make the best product, they get the cheapest deal, they have the network effect/users, the have a government monopoly, they have a cult following, they have synergistic low pricing (Costco model), they’re the bottleneck/troll under the bridge, they have all the infrastructure, etc)

Finding Companies With a Moat

The most obvious companies with moats are the companies that have products we use in everyday life, whether this be in the workplace, where you go shopping, when you are relaxing and enjoying entertainment, getting from one place to another, or going grocery shopping. They are also the companies that you've heard about from word of mouth. I believe it was Jeff Bezos who said something along the lines of, "Advertising is the price you pay for a mediocre product." A recent example of this is ChatGPT. ChatGPT spent $0 in advertising when it launched its product, yet was able to garner $10B in ARR. Great products are the moat. Also, when was the last time you saw a Costco advertisement?

One problem with the approach above is that these tend to be companies that everyone knows about, and you might want to find something a bit more obscure (though this line of thinking is typically flawed as most of the best companies in the world are trading around their 52 week highs). Well, if that's the case then you can take an approach of looking for companies with financial metrics that consistently outperform their peers and outperform the market. If you need help with finding these companies,

check out my screen for potential 100 baggers

(stocks that have the same characteristics as those that have 100x'd in the past).