- Published on

The Myth of Capitalsm - Thoughts and Review

- Authors

- Name

- Jeremy Persing

Overview

The Myth of Capitalsm - Monopolies and the Death of Competition is a book written by Jonathan Tepper with Denise Hearn and argues that we now live in a world dominated by oligopolies. Gone are the days of free market capitalism where there were no special interests involved and government had no say in how consumers chose their products. He argues that much of the rising wealth inequality in America is due to the rise of olipolies and that government intervention (FDA, patents, NRSROs) and also lack of government intervention (lack of denying mergers and acquisitions) can be to blame.

What I Liked

I thought that this book hit a vein that is pretty obvious if you observe the economy and your environment, but seems to be missing from academia. I recall being in an economics class in college and when going over monopolies we had discussed public utilities and how those are government sanctioned monopolies, but I don't recall discussing duopolies and oligopolies with real world examples. At the time, I did not really care and didn't think too much about it, but now that I am more involved with investing and trying to find great investments, it really does pay to have that type of advantage over your competitors.

While on the subject of academia, one operation that I'm surprised was not called out, yet is a clear monopoly, is the College Board (the company that administers AP Exams and the SAT). That aside, I did like the way Tepper tied in how investors use these advantages in their favor. He often mentioned Buffett and even brought up some of the concepts Peter Thiel uses in his book Zero to One: Notes on Startups, or How to Build the Future. If you study Buffett and his investment style, you will know that he prefers companies with a "moat" which can deter competition from entering their industry or stop competition from taking their profits.

M&A

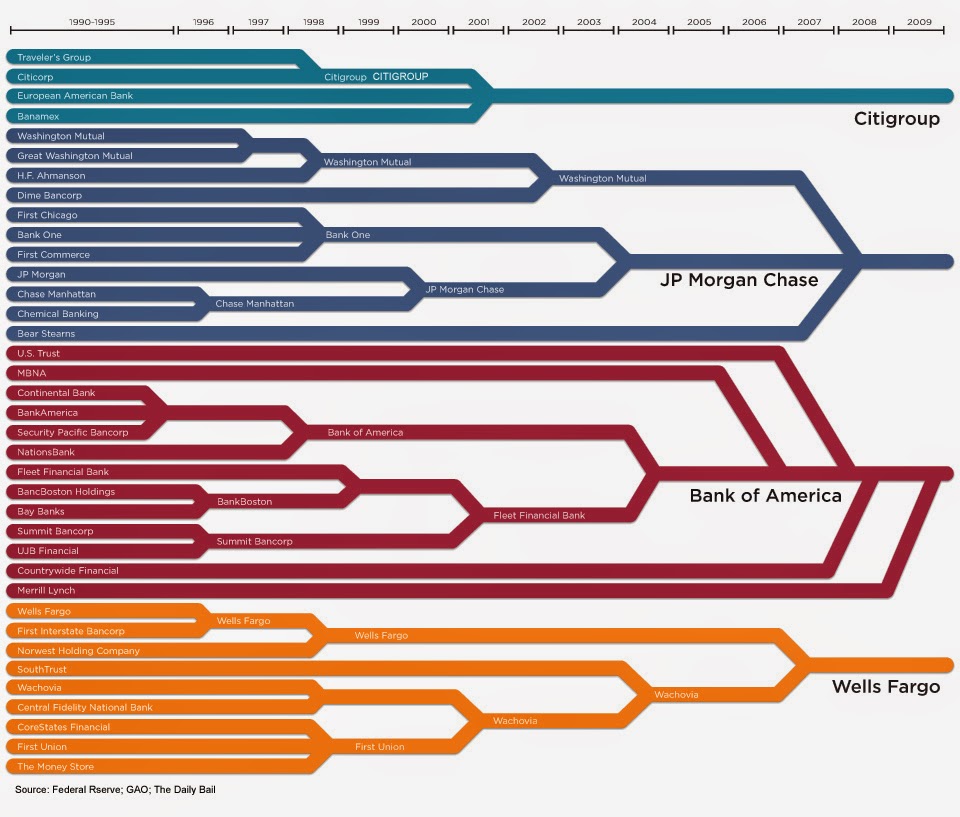

I think Tepper's critiques on mergers and acquisitions were valid. To summarize them, he basically stated that the government has been too lax on companies trying to acquire other companies. When one company acquires another in the same industry this decreases competition for that industry and leads to the acquiring firm having more market share. If this is done enough times, you end up with a situation that looks much like the US's current banking situation, where we have 4 large banks that have had tons of mergers and they dominate the market.

Since his writing of the book, the cell phone provider market has become even more concentrated with the merging of T-Mobile and Sprint. The theory behind having all of these mergers is that it will create economies of scale, the best competitors in the market will be able to produce things more cheaply and the customer will ultimately benefit. However, Tepper proves that this is not the reality. It is typical for firms to raise prices after the merger, or one company can raise their prices pre-merger "forcing" the other too as well.

Killing Competition

Tepper brings up that acquisitions aren't always for economies of scale and points to the recent time period where big tech was making loads and loads of acquisitions. These are often done to remove potential competitors. He brings up many examples, but some of the most memorable are when Amazon undercut a diapers company after they denied their acquisition proposal. In the book it stated that Amazon had priced their diapers at such a discounted price that they would be willing to lose roughly $100 million per year on the product. The diaper company obviously couldn't compete and they eventually were acquired by Amazon. There's also the example of Facebook (now Meta), who tried to acquire SNAP and then copied all of their features into Instagram after being denied. This isn't a new thing though as Zuckerberg's greatest ability is to copy features and integrate them into his platform. One that I'm surprised Tepper didn't mention was Google. I was not keen to this proposition until I heard Terry Smith talk about it, but it appears that Google is either one of the worst capital allocators in existence, or they acquire potential competition only to kill them off. Killed by Google is a website where you can see all of the products and services they have killed.

Can we Escape Them

It is interesting to think about these different companies and how it is almost impossible for the everyday American to escape using one of their products. The most notable that come to mind are Google, Amazon, and Microsoft. I choose all of these because they all have public cloud platforms, so even if you don't want to use their main products, you are likely going to be using websites which use their cloud platforms for hosting. But that aside if you have an Android phone, run Windows OS, have a Ring doorbell, shop at Whole Foods, read on a kindle, watch videos on YouTube, play Xbox, play Call of Duty, or use a plethora of other services, you are somehow providing to these companies.

Solutions

I thought that Tepper's solutions to this problem were all pretty good. The main proactive one is to buy and own stocks so that we can benefit from the wealth these companies generate. I also thought his suggestion that workers should be compensated with stock was good as well. I recently read an article by Chris Mayer which referenced how Publix did something like this and overall it led to a better culture within the company and people who had stayed with the company for many years ended up becoming millionaires.

Antitrust enforcement was a big one and getting rid of the revolving door between the political world and the corporate world was a huge one as well. Hopefully that latter option will be implemented and enforced sooner rather than later.

Score: 10/10

I thought this book was eye opening and engaging. I would recommend it to anyone interested in investing, economics, or just wanting to know more about the world.